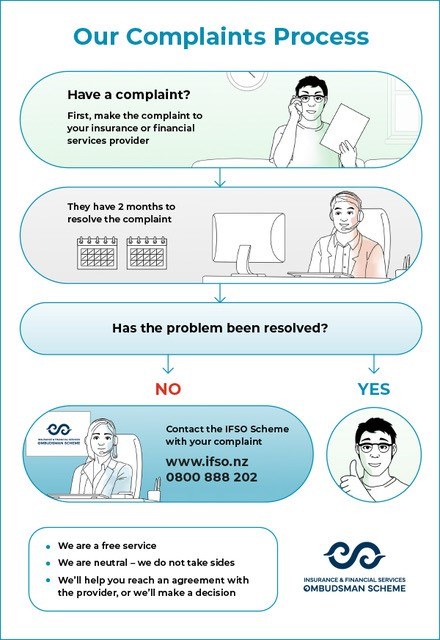

Use our enquiry/complaint form or freephone us on 0800 888 202 or email us at info@ifso.nz

Our office hours are 8.30am to 5.00pm Monday to Friday.

We can arrange an interpreter by telephone, we use the NZ Relay Service. We have information available about the IFSO Scheme on our website in 7 languages.